Ian Cassel's Filter Selecting Microcaps is Great

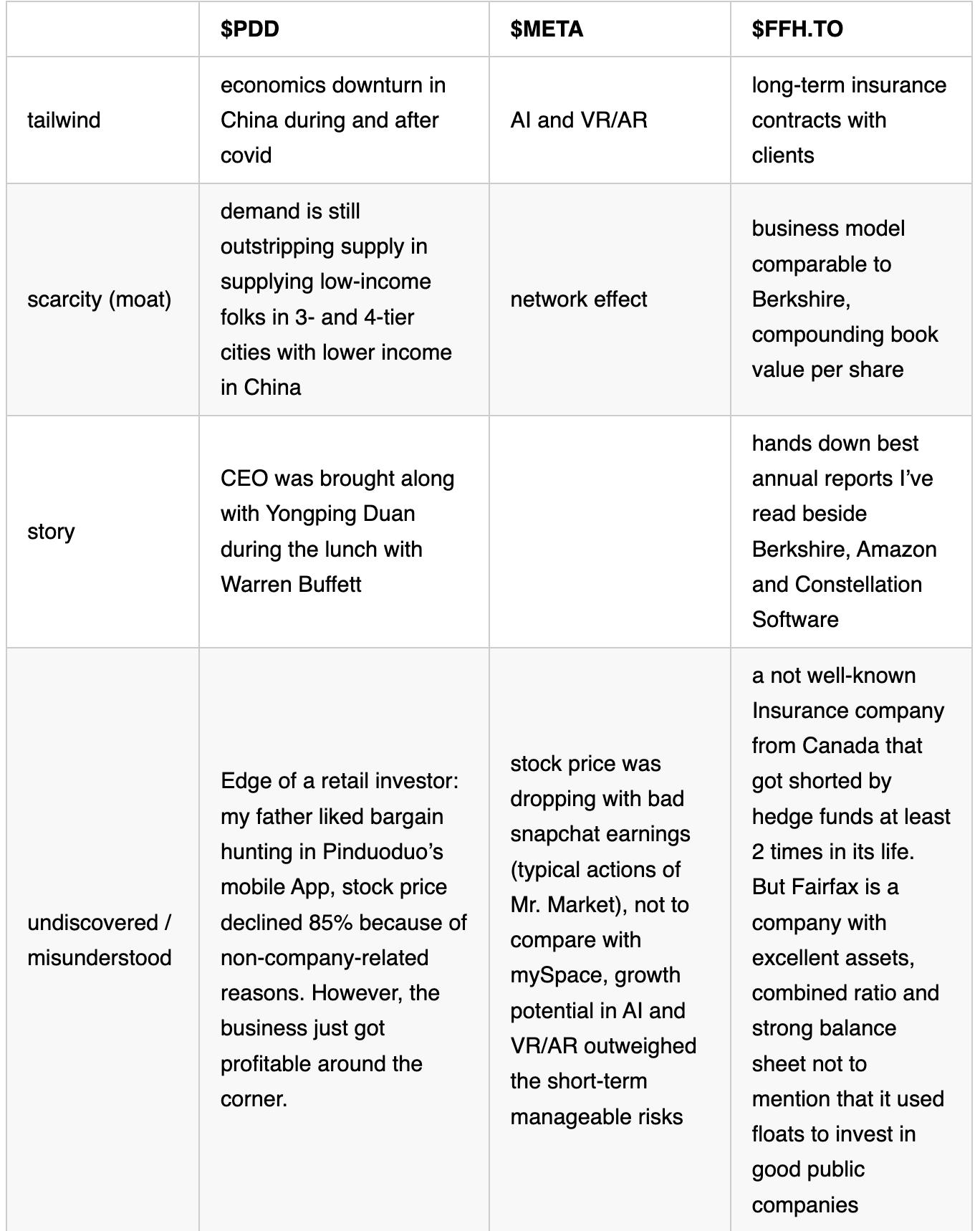

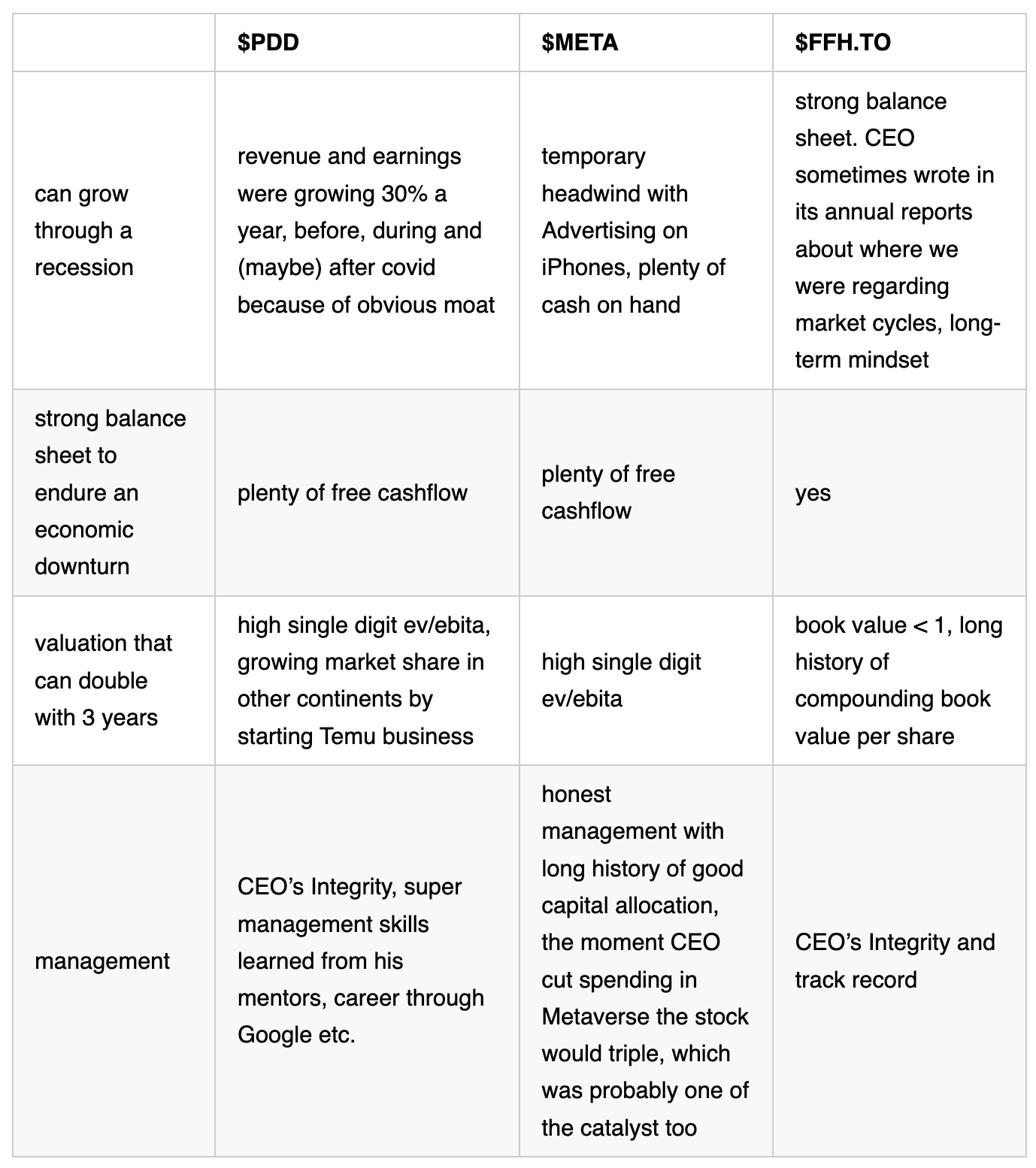

$PDD $META $FFH.TO

top-down

- tailwind

- scarcity/moat

- story: this might be the most difficult part

- undiscovered

button-up

- can grow through a recession

- strong balance sheet to endure an economic downturn

- management

- a valuation that can double within 3 years

and pay attention to minimal dilution.

Below are 3 examples:

Btw. I find the process / filter works well my checklist

BR

What do you really know about Pinduoduo PDD?

The truth is not much.

I say this because PDD deliberately don't disclose the kind of information that investors need.

When a company is deliberately opaque, one needs to ask why.

See this fascinating expose/analysis from the Financial Times: https://youtu.be/2d8j_q2tl9c?feature=shared

I bet you change your mind about PDD after watching

Didn't Mark Twain once say "It Ain’t What You Don’t Know That Gets You Into Trouble. It’s What You Know for Sure That Just Ain’t So"

My advice is to understand what you are investing in and if you can't, move on. The CEO may have been introduced to Buffett, but Berkshire didn't invest. Buffett has been introduced to many people over the years, but that isn't a reason to invest.

I know Ian Cassel personally. I doubt that he would invest in PDD - not least because Ian is interested in small cap companies that have more chance of doubling in value in 3 years than a business valued in hundreds of billions of dollars. So PDD is a strange example when using Ian's filter selection.